Sign Up with Confidence for Some of Sri Lanka's Most Attractive Treasury Bill Rates and Great Digital Service with CAL!

The Island's First Digital Treasury Bill Investment Portal

Start Your Investing Journey

Start investing in minutes by signing up for the CAL Digital Investing Portal!

Thank you! Your submission has been received!

Log In

Already have an account?

Don't have an account?

A Trusted Pioneer in the Treasury Market

CAL Conducts over LKR 300 Billion in Treasuries Transactions Annually Which Is Testament to Our Clients' Trust.

Signing Up on Your Own Is Easy!

You can sign up to CAL's Digital Investing portal in just 3 easy steps, without having to pick up the phone to call us for guidance or visit us to fill in manual forms.

Sounds Similar to Your Investment Problems?

Deciding which investment product to select in today’s market and how to invest can involve many questions!

- Are you tired of below-average interest rates on your traditional deposit or savings?

- Living abroad and wondering where to invest your money to get a higher return?

- Tired of not being able to enjoy Sri Lanka's competitive treasury bill rates while abroad?

- Frustrated with the inconvenient, manual process to purchase a Treasury Bill?

A One-Minute Guide on Purchasing Treasury Bills Through the CAL Portal.

Our video walk-through takes you inside the CAL Digital Investing portal and shows you how to invest in Treasury Bills with ease. Learn how to open your Treasury Bill account, transfer funds, and start investing with our quick guide.

Watch the One-Minute Guide

Two Common Clarifications Our Treasury Bill Customers Request

Investing in Treasury Bills is made simple with CAL Digital Investing; however, due to the unique nature of the investment, there are certain questions that many have before they invest.

Where does my investment show?

- Your investment resides with the Central Bank of Sri Lanka (CBSL) after you invest

- Treasury Bills are issued in scripless or electronic form minus a physical certificate

- Your investment resides with the Central Bank of Sri Lanka (CBSL) after you invest

- It is opened under your name where your ownership and Treasury Bill title will be recorded

Where do I transfer my money?

- Your investment resides with the Central Bank of Sri Lanka (CBSL) after you invest

- Treasury Bills are issued in scripless or electronic form minus a physical certificate

- Your investment resides with the Central Bank of Sri Lanka (CBSL) after you invest

- It is opened under your name where your ownership and Treasury Bill title will be recorded

Why Are Many Sri Lankans Buying Treasury Bills Through CAL?

We’re liberalizing access to the largest investment asset class!

Some of the most competitive interest rates in the market today

Considerably lower service fees for auctions and transactions

Sri Lanka's first digital investing portal for Treasury Bills

Free account creation and min. investment of LKR 1 Million

Are Treasury Bills My Only Investment Option from CAL Digital Investing?

No! CAL’s wide Digital Investing offering matches the needs of different types of investors and the portal ensures ease-of-investment for all. Whether you opt for Unit Trust Funds, Personal Wealth Management (PWM), or Equity (stocks), the CAL Digital Investing portal makes it simple to reach your investment, financial, and life goals.

Unit Trust Funds

Own top investment assets with relatively low capital, with the flexibility of being able to pull out your money or invest additional sums whenever you want.

Private Wealth Management (PWM)

For investors looking to diversify private wealth with LKR 100 million-plus investments, PWM gives access to multiple asset classes and bespoke wealth management.

Equity (Stocks)

They carry high-risk but stocks let you benefit from the growth of top listed companies and conglomerates in the CSE including S&P SL20 companies.

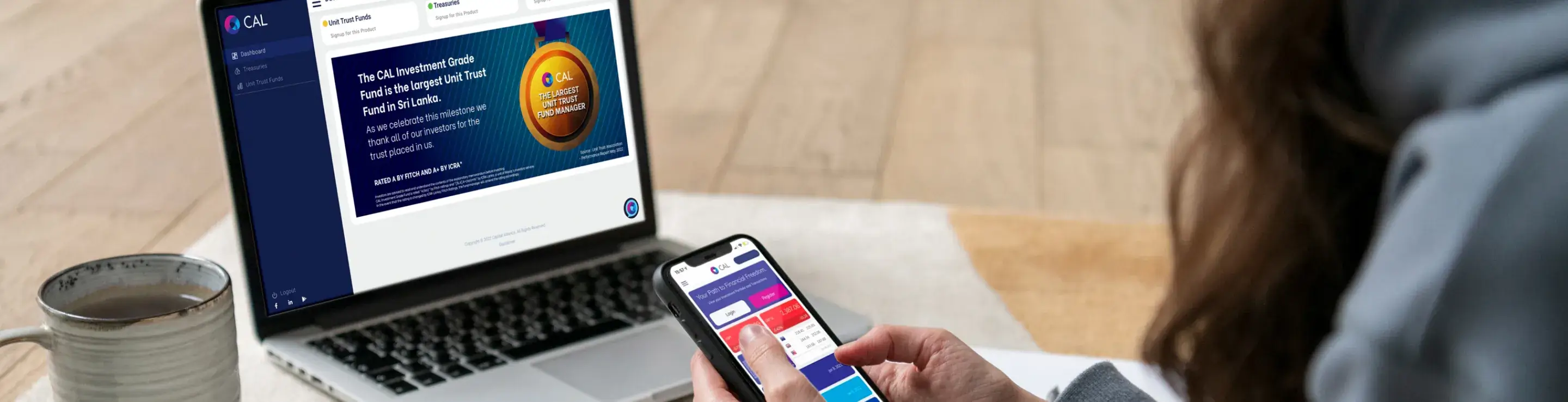

Why Do Many Sri Lankans Now Use the CAL Digital Investing Portal?

Whether digitally savvy or not, a beginner to investing or more advanced, you'll feel at home inside the CAL Digital Investing Portal as it is simple to use. Many users say it's as easy as digital or online banking. Here, we look at some of its benefits!

Sign up for the portal and invest digitally, without leaving your home or office

Invest in Treasury Bills and other products like Unit Trusts through the portal

Make investment requests fully digitally with transactions also facilitated online

Enjoy the freedom and mobility to make anytime, anywhere investments

Invest, access returns, manage your portfolio, perform research, and more

Access Treasury Bill investments even when residing abroad